Contents

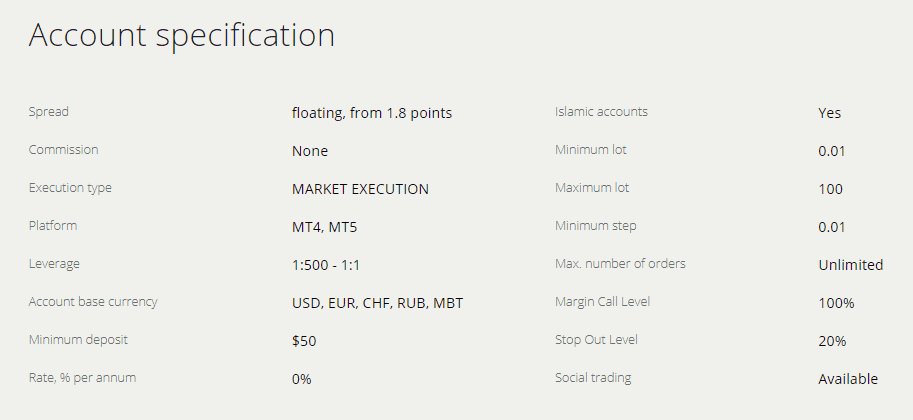

Most of these transactions are made through a broker or an online stock-trading platform. A direct stock plan or a dividend reinvestment plan may charge you a fee for that service. A discount brokerage charges lower commissions than what you would pay at a full-service brokerage. But generally you have to research and choose investments by yourself. A full-service brokerage costs more, but the higher commissions pay for investment advice based on that firm’s research. Another way to categorize stocks is by the size of the company, as shown in its market capitalization.

You and the company will need to sign a contract that outlines the terms of the stock options; this might be included in the employment contract. Trying to wrap your mind around the stock market is no easy task! But the good news is that you don’t have to navigate the stock market and investing on your own. With help from a financial advisor you can trust, you can get a better handle on the stock market and start investing for your future.

However, institutional investors with significant ownership stakes tend to highly value voting rights. Please see Open to the Public Investing’s Fee Schedule to learn more. Stock Market — The stock market refers to a collection of exchanges where companies list shares of stock for sale. Investors can then buy and sell these stocks among each other. Preferred stocks — These types of stock give preferred stockholders different treatment when paying dividends .

Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. If a lot of people want to own part of a certain company, then that company’s stock price rises. A primary market is a market that issues new securities on an exchange, facilitated by underwriting groups and consisting of investment banks. The stock market guarantees all interested market participants have access to data for all buy and sell orders, thereby helping in the fair and transparent pricing of securities. The market also ensures efficient matching of appropriate buy and sell orders. The stock market ensures price transparency, liquidity, price discovery, and fair dealings in trading activities.

Compare this to a stock market, which refers to the general operation of trading stocks and includes stock exchanges, over-the-counter markets and electronic trading systems. Investors benefit by exchanging their money for shares on the stock market. As companies put that money to work growing and expanding their businesses, investors reap the benefits as their shares of stock become more valuable over time, leading to capital gains. In addition, companies pay dividends to their shareholders as their profits grow.

While all of the above sounds complicated, it doesn’t have to be. We’re going to look closer at what a https://en.forexbrokerslist.site/ market is, how it works and how you can start to invest in this arena. Other commonly used financial ratios include return on assets , dividend yield, price to book (P/B) ratio, current ratio, and the inventory turnover ratio.

The main benefit with a https://topforexnews.org/ able brokerage account is that you can take money out of the account at any time without having to worry about early withdrawal penalties. Once you’re ready to invest, we recommend investing 15% of your gross income toward retirement. If a company goes bankrupt and its assets are liquidated, common stockholders are the last in line to share in the proceeds.

Call options give the owner of the option the right to buy the underlying stock. Call options increase in value if the underlying stock increase in price. Some companies also give out dividend payments each year to stockholders, which can add value. Is marketed to people with low credit scores as a supposed replacement for a Social Security number — It’s illegal and often part of credit repair scams. In its most basic form, it is the assets that remain in a company after covering all the bills . This metric can be used to get a better understanding of the value of the stock.

There are plenty of catalysts that can push the https://forex-trend.net/ up or down. For example, in the 2022 stock market downturn, inflation pressures, supply chain issues, rising interest rates, and inflation fears were big reasons for the market’s poor performance. But, at the end of the day, these factors resulted in more investors selling stock than buying, which is why we saw stock prices generally decline. The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Companies will list their stock on one of these exchanges – it goes through a process called an initial public offering, or IPO. Once the stock is listed, investors can then buy its shares and the company can use the funds to grow its business. The exchange then tracks the supply and demand of listed stocks and investors can trade among themselves.

Stocks in 1997, it would have almost quadrupled to $400,000 by 2017, but there would have been many ups and downs due to volatility. A more diversified investment portfolio would have had a lower return, but reduced volatility. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

Like a rise in the value of your home or any other asset you own, the increase represents a potential gain that can be realized upon sale. Chartered Financial Analyst Thomas J. Brock explains why you might choose the stock market. The Dow Jones Industrial Average is one of the three most popular stock market indexes in the US. When an investor buys stock, they are hoping that the stock will go up in value. The ultimate goal of an investor is to sell the stock for a profit. Company About Discover how we’re making the markets work for all investors.

Research from the University of California suggests that only 1% of day traders are able to predictably make a profit after fees. This involves borrowing money from a broker to purchase more stocks. It could amplify an investor’s losses if things don’t go as planned. If you have an employer-sponsored 401, you may be able to buy and sell individual stock shares. In addition, 401s typically allow participants to invest in other assets like bonds, mutual funds and more.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Again, owning a stock doesn’t mean you carry a lot of weight within the company, or that you get to rub elbows with company bigwigs. It also doesn’t mean that you own a piece of the company’s assets — you aren’t entitled to a parking spot in the company lot or a desk at the company’s headquarters.

Occurs when incomplete information leads you to pay or charge an amount that doesn’t match an undisclosed risk. Stay informed on the most impactful business and financial news with analysis from our team. And once you turn age 65, you can use the funds inside your HSA for non-medical expenses if you want to .

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for over 15 years, and was a senior writer and spokesperson at NerdWallet before becoming an assigning editor. Arielle has appeared as a financial expert on the “Today” show, NBC News and ABC’s “World News Tonight,” and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Years ago, achieving an appropriate level of diversification was a complex and costly endeavor. Today, it’s a simple and inexpensive process, thanks to the myriad of low-cost index funds and exchange traded funds that provide exposure to different industries and geographic regions.